Rising wages and continued skills shortages make it more important than ever that logistics occupiers fully understand labour costs and availability when making location decisions. Guy Douetil from Hickey & Associates outlines the challenges created by a tight logistics labour market.

LARGE AND VARIED WORKFORCE

The logistics workforce is large, with industry body Logistics UK estimating that 2.7m people work in logistics roles, or 8.2% of total employment. This includes staff working in a varied range of positions including drivers, warehouse operatives, mechanics, technicians and management roles. With warehouse occupiers increasingly embracing new automated technologies, the workforce also includes less traditional jobs such as data and digital specialists.

Logistics labour trends have mirrored those seen in the wider UK jobs market over recent years. While labour conditions have loosened moderately, with job vacancies falling from the peaks of the pandemic and wage growth easing from the highs of mid-2023, the market remains tight by historical standards. Those recruiting staff in the sector continue to face significant challenges; and the availability of skills and labour remains a key consideration in all location decisions.

SKILLS SHORTAGES & CHALLENGES

Skills shortages continue to be a major issue within the logistics sector, albeit the acute scarcity of HGV drivers that grabbed national headlines during the pandemic has become less critical. The number of people taking HGV tests has increased significantly, to rise well above pre-COVID levels over the last two years. However, driver shortages have still not been fully resolved, and the age profile of the occupation remains a concern, with more than half of drivers estimated to be over 50 and approaching retirement.

Logistics UK has more recently found that firms in the sector are reporting greater difficulties in recruiting fitters, mechanics and technicians, partly because some workers in these jobs have switched to HGV roles. A diminishing pool of EU workers following Brexit has also had a significant impact, as around a fifth of those in logistics roles are non-UK nationals. Further challenges may be created by the imminent tightening of immigration rules, with the salary threshold for skilled worker visas set to rise from £26,200 to £38,700 in spring 2024.

The logistics sector also continues to suffer from an image problem, lacking appeal as a potential career for young people. It struggles to attract female workers, who account for only about 15% of the logistics workforce, while ethnic minorities are also underrepresented. Warehouse shift patterns do not suit many workers, especially if they include night work; while a further limiting factor on recruitment is the need for most staff to have access to a car to reach logistics parks.

COUNTING THE COSTS

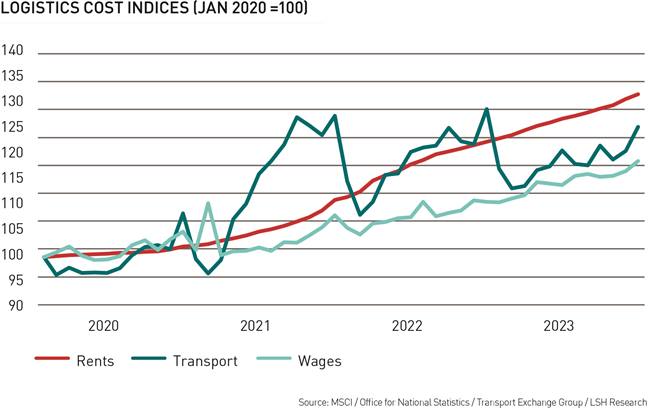

Competition for staff has pushed up logistics wages in recent years. Office for National Statistics data shows that transport and distribution pay has risen by 19% since the start of 2020. Wage growth has eased a little after peaking last summer, but annual growth in regular pay was still as high as 6.3% in December 2023.

Rising wages have had a significant impact on the overall costs of warehouse occupiers, as labour is one of their two biggest operational expenses, alongside transport. While costs vary greatly between firms, labour and transport together account for at least three quarters of total operational expenses for many in the sector.

Transport costs have risen by an even greater extent than wages since the start of 2020, increasing by 25%, although these have been more volatile and followed the path of fuel prices. A 32% increase in industrial rents over the same period, as recorded by MSCI, has outstripped the rises in both labour and transport prices, but has had a smaller net impact on most firms’ overall costs with rents typically accounting for 10-15% of total operational expenses.

BALANCING ACT

Logistics occupiers’ location decisions involve a complex balancing act, weighing up costs and access to transport networks and labour pools against other considerations such as power availability. Firms will usually start by seeking sites that provide optimal access to transport networks, but suitable land or buildings may be in short supply or expensive in such locations. The best ‘dots on the map’ for transport access may not provide the best labour pools, or they may be in existing logistics hotspots where wages are relatively high.

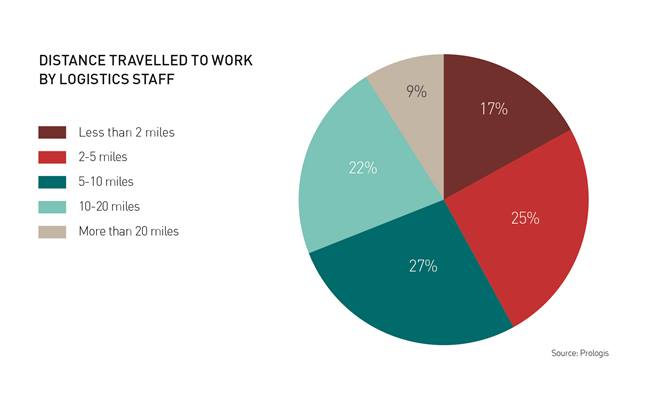

Access to nearby labour is essential in the logistics sector, as commuting times are relatively short. Research by Prologis indicates that 69% of logistics and warehousing personnel travel 10 miles or less their workplaces. Workers in lower paid roles, in particular, can not be expected to commute much more than 20 minutes, especially if there is competition from other nearby employers offering similar jobs.

STAFF RETENTION IS KEY

With skills in the sector being relatively transferable, many logistics workers are prepared to move around between jobs on a regular basis in search of higher wages or shorter commuting times. Employees will make their own trade-offs; deciding, for example, whether an extra five minutes of travel time is worth an extra 50p per hour in wages. The fluidity of the logistics labour market leads to high employee attrition rates in many firms, and significant costs are created by the need to regularly recruit new staff.

Staff retention is thus as much, if not more, of a challenge than recruitment within the logistics industry. With employees sensitive to increases in commuting times, firms risk losing large sections of their workforces if deciding to relocate even relatively short distances. Expanding existing operations by, for example, adding mezzanine floors may often be preferable to moving to a new site and having to recruit a new workforce.

IMPROVING WORKING ENVIRONMENTS

Wage increases are the most obvious tool available to companies seeking to recruit and retain staff. Aldi, for example, has increased warehouse workers’ basic pay twice in the last six months, to £12.00 an hour (£13.55 inside the M25), bringing it in line with the Living Wage Foundation’s National Living Wage.

However, pay increases can only go so far in making logistics roles more attractive. Improvements to working conditions and staff benefits such as pensions are also important, and potentially more crucial to the longer-term retention of staff. Better access to training and the establishment of clearer career paths for those entering the sector may also help to reduce staff attrition.

Staff wellbeing has risen up the agenda of major logistics occupiers. This has led to the introduction of enhanced employee amenities, with gyms, cafés, football pitches and green spaces becoming more commonplace. With logistics workplaces often being hot, cold or noisy, anything that can be done to create a more pleasant working environment can go a long way towards improving staff satisfaction.

Initiatives to support flexible working and better work/life balances are also being explored by logistics employers, albeit their options are restricted as homeworking is not possible for the vast majority of roles. Nascent ideas to improve flexibility include the introduction of ‘family contracts’, where, for example, a husband and wife commit to working a certain number of hours between them.

FUTURE WORKPLACES

The rise of automation and robotics in warehouses is causing a gradual shift in the labour needs of logistics operators, and some firms that have invested heavily in automated technologies have made significant reductions in staffing costs. As new technologies spread throughout the industry, a move towards smaller, but higher skilled workforces will be seen over time.

For now, though, most logistics operators remain heavily reliant on large manual labour forces. With the UK jobs market likely to remain tight and competition for staff staying strong, the onus will remain both on individual employers and the logistics industry as a whole to take actions that improve the attractiveness of logistics careers.

Guy Douetil

Managing Director, EMEA - Hickey & Associates, LLC

REGISTER FOR UPDATES

Get the latest insight, event invites and commercial properties by email